Student Loan Management

━ Expert Guidance That You Can Trust ━

Student Loan Management

If you're struggling to make your minimum student loan payment every month, have fallen behind, or have already defaulted on your student loans, there is still hope. You may be eligible for relief through federal student loan forgiveness programs . We will help you explore various federal programs that have the potential of lowering your payments, and can qualify you for student loan forgiveness

years of unbeaten & trust of customers around the world

Choosing to postpone payments through forbearance or deferment options (usually recommended by loan servicers), is one of the biggest mistakes borrowers make when payments become due. There are much better options available that loan servicers typically do not inform borrowers about.

Why Not?

Much like a normal bank, student loan servicers collect a large profit from the interest accrued on your student loans. Therefore the more interest you accumulate, the more your servicer gets to collect.

The Truth about Forbearance and Deferment

The most expensive way to manage your student loans is by using deferment and forbearance time since your student loan balance continues to grow throughout this process as interest never stops accumulating until you pay the loan off.

Many borrowers are shocked to find that their balances can easily grow out of control after a few years of putting off their payments through deferment or forbearance.

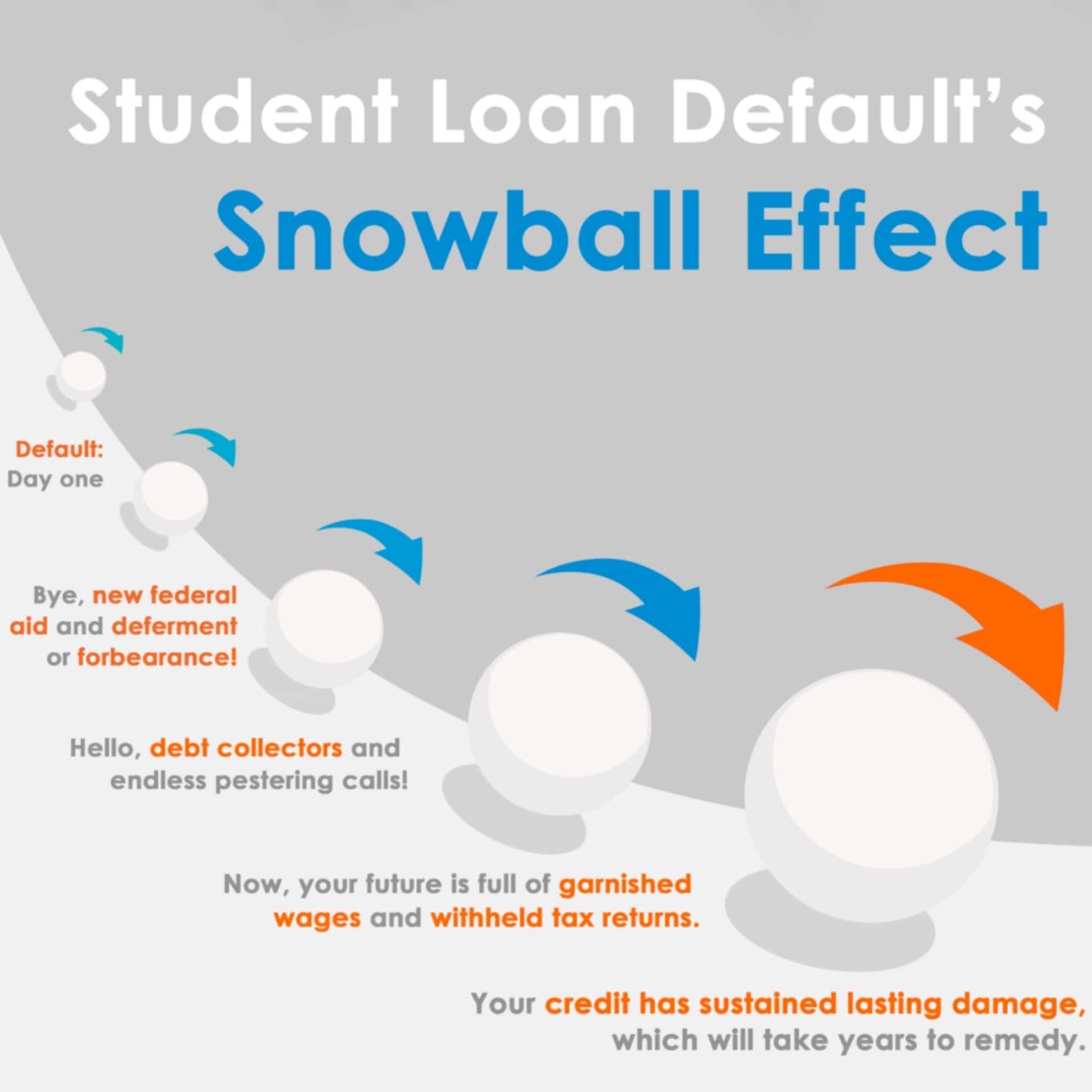

With an increased balance and in turn an increased monthly payment, borrowers who initially had a tough time making the original payment will now have no choice but to fall into default.

The Risks of Deferment

After you use up your three years of forbearance and deferment time, your loan servicer has guided you into a position where you have two options remaining:

1. Brace yourself and budget for a much higher monthly payment. 2. Default on your loan after coming to terms that the higher balance and monthly payment are unmanageable.

━ We are here to help ━

Solutions To Your Student Loan Struggles

- Student Loan Forgiveness

- Financial Analysis

- Loan Consolidation

- Repayment Programs

Student Loan Forgiveness

Whether you owe $5,000 or $500,000 - The federal student loan forgiveness program is an option that can help anybody with student loan debt. You would only be responsible for paying back a small portion of your total national student loan debt, and the US Department of Education would forgive the remaining balance.

Even if your loans are delinquent or have fallen into default, you may still be eligible for the following services:

- Student Loan Consolidation Program to lower your monthly payments, as well as improve your credit.

- Repayment Programs to make affordable payment adjustments based on your income

- Federal Student Loan Forgiveness Programs that can eliminate a significant portion of your total federal student loan debt balance.

- Annual Recertification for your repayment programs to ensure your receive the forgiveness you qualified for.

Financial Analysis

The most expensive way to manage your student loans (besides outright defaulting on your student loans due to non-payment) is by using deferment and forbearance time. Your student loan balance continues to grow throughout this process, as interest never stops accumulating until the loan is paid off. Loan servicers usually encourage people to use these options because they maximize their profit by increasing your balance.

Loan Consolidation

People are usually shocked to find that their balances can practically double by putting off payments with deferment or forbearance. When your student loan balance goes up, your payments increase as well, making your loan even more unmanageable. There is no benefit to putting off the inevitable... you are going to have to pay your student loans back eventually.

Repayment Programs

Allied Enrollment Centers has solutions for all of your student loan problems.

We will help you explore various federal programs that will lower your payments, and we can help you qualify for student loan forgiveness - two options that your loan servicer will not offer you.

Why Not?

Your loan servicer profits from your misfortune, and if you receive loan forgiveness or consolidate your payments, then your loan servicer does not get to collect all of the interest from your high balance.

Financial Analysis

Work with our professional loan counselors to get a better understanding of your financial situation and create a plan to pay off your loans.

Loan Consolidation

Consolidate all of your payments into one low-interest program to simplify your bills, lower your monthly payments and your credit score

Repayment Programs

Our counselors will work with you to formulate an affordable repayment program based on your income that avoids deferred payment options.

Loan Forgiveness

Get application assistance for the federal student loan forgiveness program that could eliminate up to 95% of your outstanding qualified debt!